FREE

Client Portal

Communicate with your clients in an electronically secure environment where you can freely chat and exchange documents.

FREE

Client Questionnaire for Individuals and Business (English and Spanish)

Probably the most effortless way to gather information about your clients and their cases in the tax resolution business.

FREE

Incoming and Outgoing Email Correspondence

Let us copy your work-related emails to the software so you can work with fewer distractions.

FREE

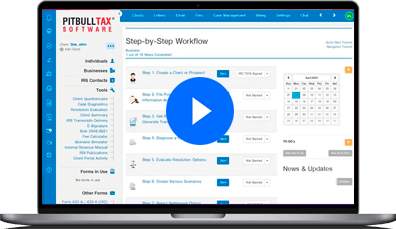

Step by Step Workflow

A logical step by step approach on how to analyze, create and prepare your tax resolution case. On PitBullTax, you get one workflow per case!

FREE

Resolution Evaluation

Find in one screen whether your client is a candidate for an Offer in Compromise, Installment Agreement or Currently Not Collective status. Is there any better way to start a tax resolution representation procedure?

FREE

Case Diagnostics

Use your client's information to identify their situation. Find the best solution and the forms you will need for a successful representation.

FREE

Fee Calculator

Estimate your fees for each case. The software will suggest minimum and ideal fees as well.

FREE

Integrated IRS Forms and Supporting Schedules

See with your own eyes how easy it is to represent a client when your tax resolution software auto populates most of the forms for you.

FREE

Engagement Letter and Document Request

We prepared templates so you will not waste time preparing a new welcome email for each client. Feel free to adapt them to your needs.

FREE

Searchable Internal Revenue Manual

An easily browsable tool to find the information you require from the IRM (IRS probably hates us for the quality of this resource!)

FREE

Customizable Response Letters

Create your own letter templates in order to communicate with your clients.

FREE

Expert Tips and Techniques

We included so many tips and tax resolution techniques throughout the software we already lost the count.

FREE

Enhanced Forms Preview

Review how your forms will look without the need to print them.

FREE

History Log

We save a timestamp of all changes worked in all cases, so you can refer to them when needed.

FREE

IRS Contact List

Gather a list of IRS staff and link them to your clients' profiles as needed.

FREE

2-Factor Autentication (2FA)

An easy-to-setup extra security layer for your PitBullTax account.

FREE

Zoom Integration and Recording of Meetings with Integrated Billing

Start and schedule Zoom meetings with your clients. Optionally, charge for the meeting and save the recordings too.

FREE

Client Questionnaire Reminders by Text and Email

If your clients take long to start sending you information, use this tool to remind them you are waiting for their replies.

FREE

File Storage Synchronization with Dropbox, OneDrive and Google Drive

Continuous backup of your clients' data to your Google Drive, Microsoft OneDrive and Dropbox accounts.