Get PitBullTax Transcripts Today and Save BIG!

No Set Up Fee. No Maintenance Fee. No Contract. Free Upgrades and Free Technical Support.

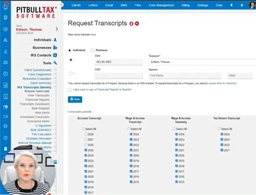

Integrated Version

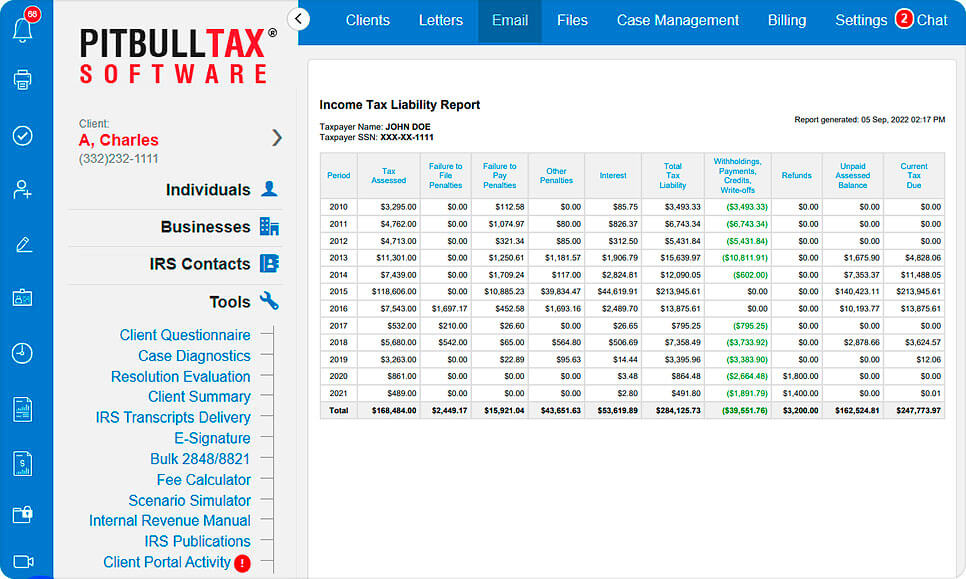

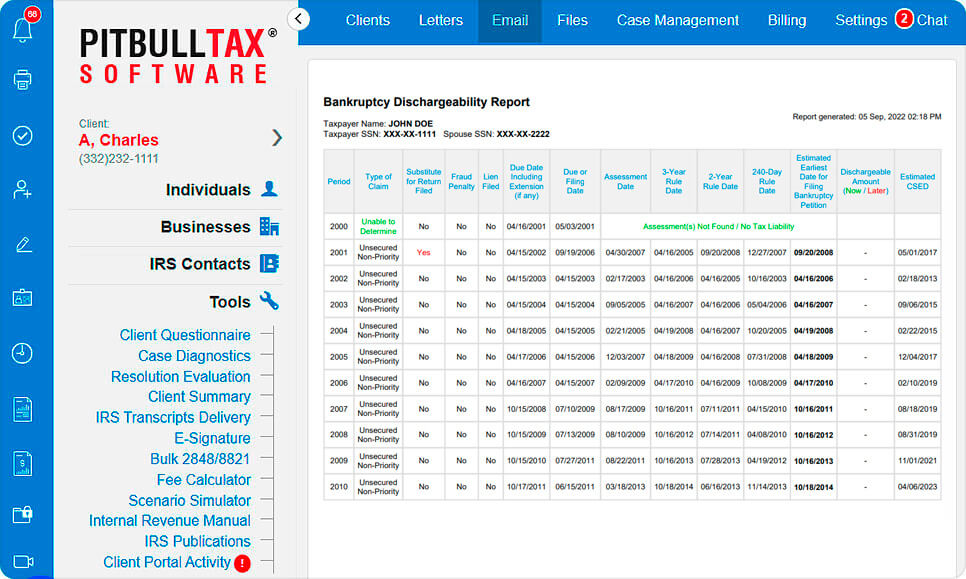

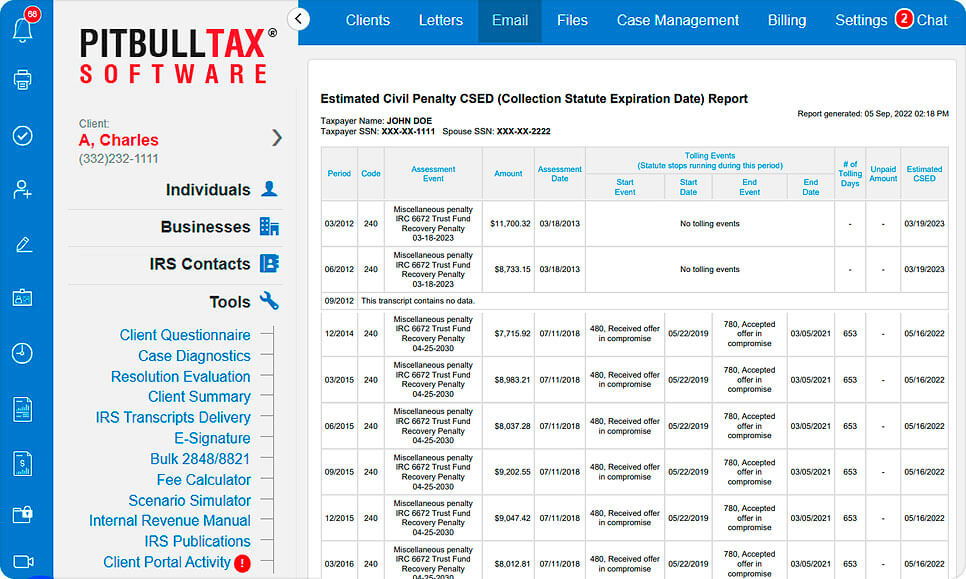

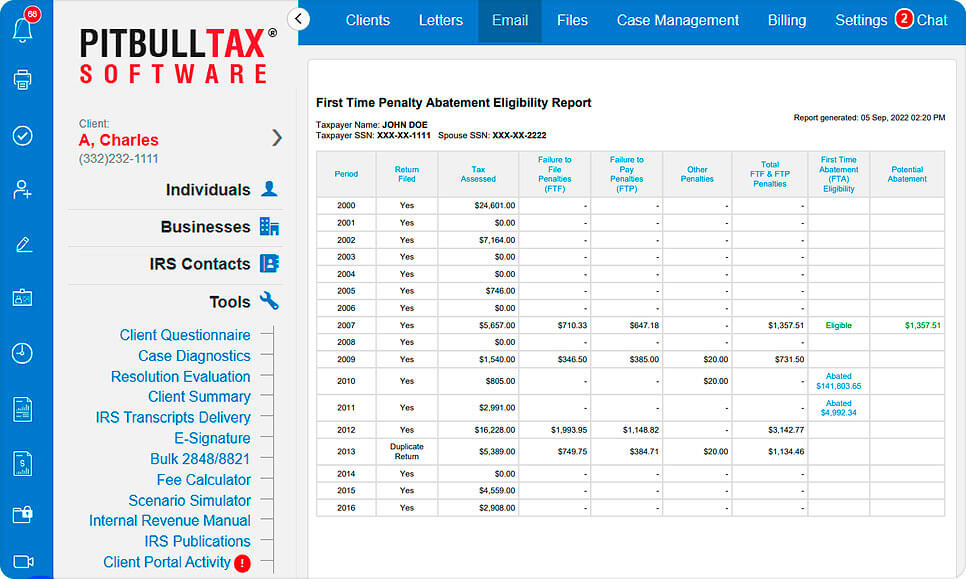

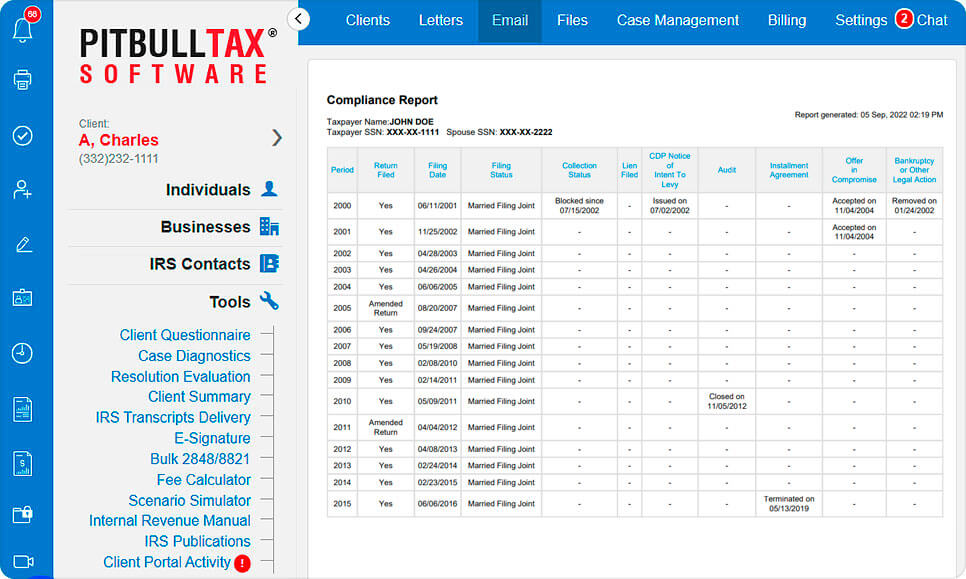

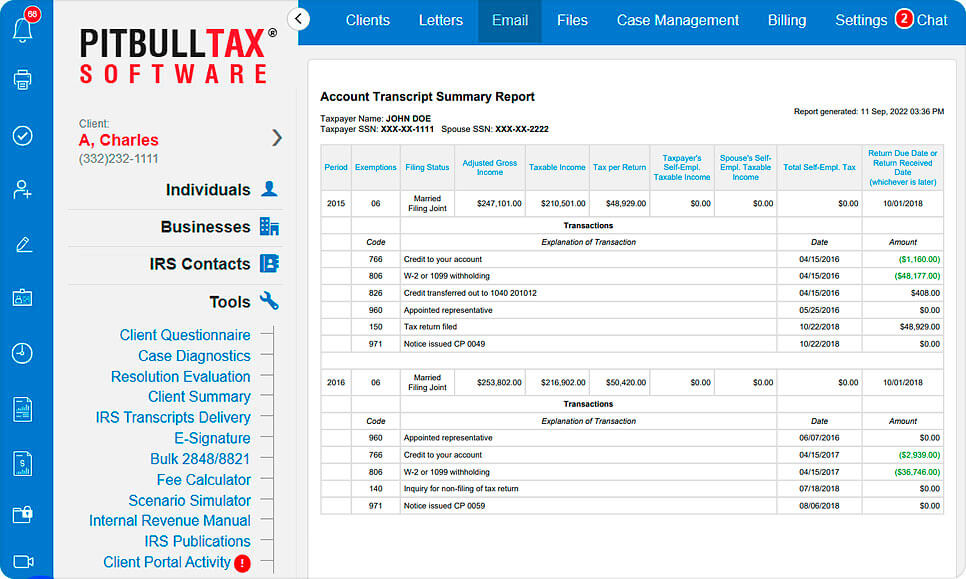

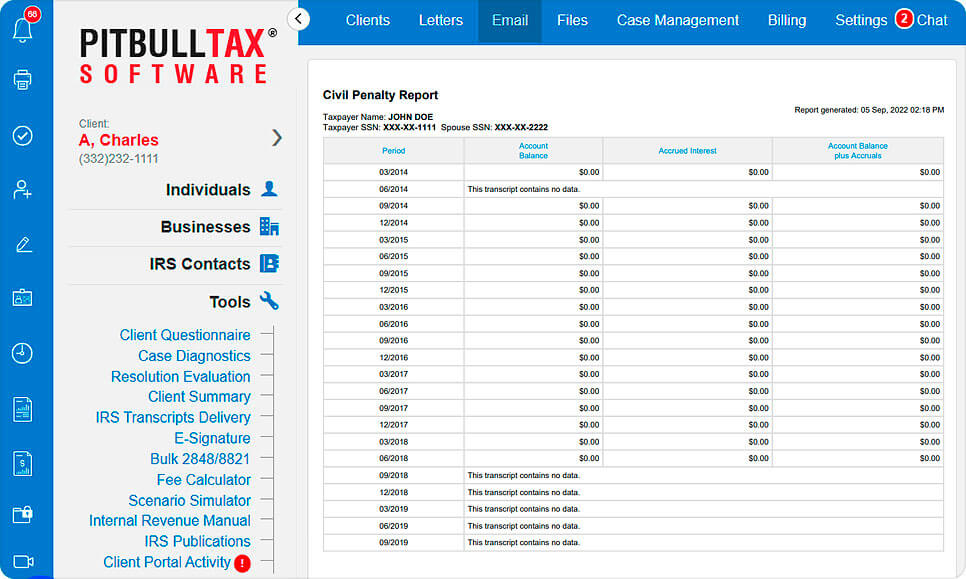

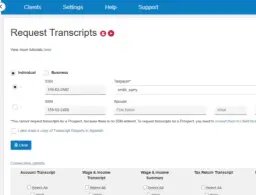

Available as an integrated add-on in PitBullTax Software. All data from Account Transcripts flows directly to PitBullTax Software Forms and Tools. Requires purchase of PitBullTax Software license.

Stand-alone Version

Works as stand-alone web-based application. This version does not require purchase of PitBullTax Software license

$390

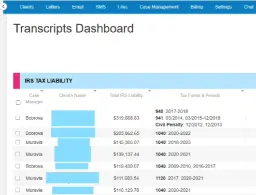

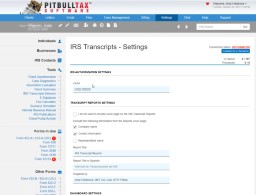

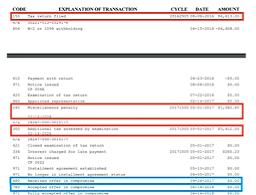

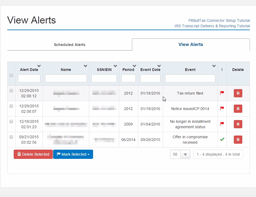

Both versions have the SAME GREAT FEATURES:

View Demo

A picture is worth a thousand words… A video is worth even more!